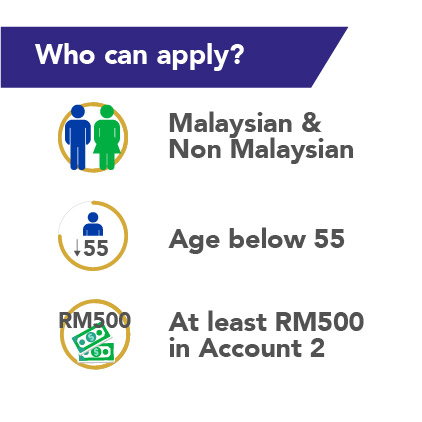

Monthly instalment payments should not exceed 55 years of age. However to apply for this withdrawal service of at least 3 years is required.

Epf Withdrawal For Housing Loans Reduction To Withdraw Or Not

You can withdraw money from your PF account to buy a home even if it is being registered solely in the name of your spouse or jointly in your and your spouses name.

. Better to withdraw from EPF account 2 to housing loan as following points. In the case of re-financing the loan balance accounted for is based on the original housing loan payment from the first loan provider OR the latest loan balance whichever is lower. Some of these include your overall financial position.

The initiative gets a shot in the arm by allowing members of EPFO ie. The purpose of the loan is to reduceredeem the loan balance of a house bought overseas. Within three years of account establishment EPF members can use the funds collected in their accounts to help them with housing requirements.

Everything You Need to Know about EPF Challan. These reasons are. For subsequent withdrawals you can apply as early as 30-days before your final monthly instalment payment.

So if a full housing loan 100 is obtained the maximum that can be withdrawn is up to 10 of the price of the house. 18 hours agoThe terms of the Employees Provident Fund EPF scheme allow you to withdraw money from your account for a variety of reasons. These are - online claim settlement upon death of member online payment of PF.

The original housing loan balance has been fully settled. The government it seems is pulling out all the stops in making Housing for All by 2022 a success. Eligibility criteria to get home loan against the PF.

EPF members can ask for a pf amount withdrawal of up to 90 of their accumulated corpus to make a down payment on a. Purchaseconstruction of a home childs wedding. Money from EPF Account 2 can be used to pay the price difference between the SPA house price and the housing loan amount up to an additional 10 on the price of the house.

Those who have completed five years of their service are eligible to withdraw money from their Provident Fund to renovate their house. Higher loan eligibility means you can now afford the home youve always wanted. You set aside part of the savings in your Account 2 to a Flexible Housing Withdrawal account.

Withdrawal from Account 2 to pay monthly housing loan. EPFO has allowed members ie. EPF withdrawal Rules for home loan repayment A member can withdraw up to 90 per cent of the total EPF amount to pay back home loans provided the house is in the name of the member or is held jointly with a spouse.

PF withdrawal facility is available to both public and. However if youre unemployed for more than 2 months you can withdraw 75 of your EPF corpus. Here are 5 suggestions to channel your EPF money back to your retirement fund.

When evaluating your loan eligibility the financial institution considers your monthly EPF contribution as part of your income. How It Works. Housing Loan Monthly Instalment.

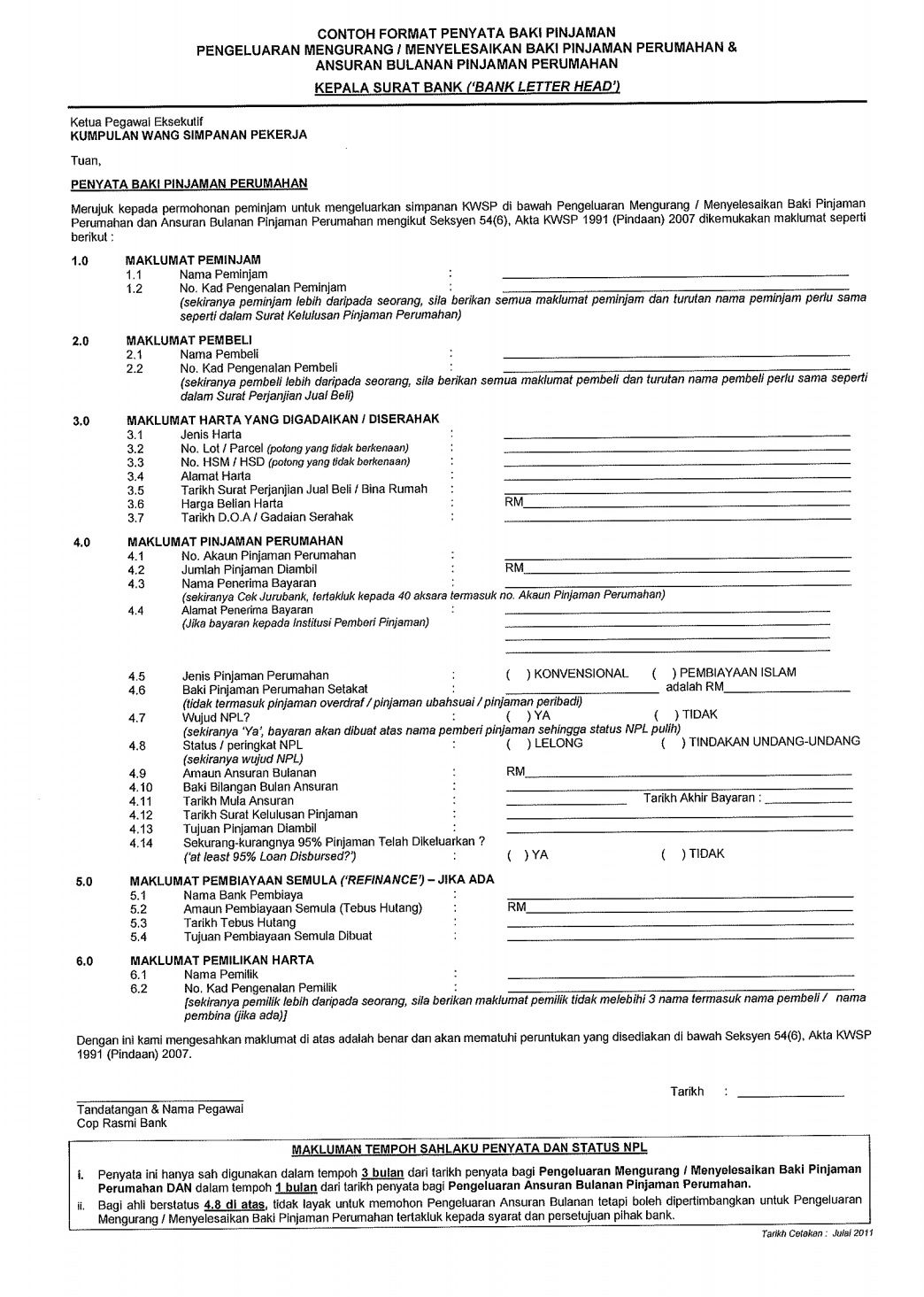

To facilitate EPF Members in preparing for a comfortable retirement the EPF allows you to make a partial or full withdrawal from your savings to meet the specific retirement-related needs that are in line with the EPFs current policies. EPF is a retirement savings plan and you can withdraw it only after retirement. Tofacilitate housing needs of EPF Members Insertion of new provision Para 68-BD in EPF Scheme 1952 Applicable from 12.

Is it good to withdraw PF for a home loan. If an individual has completed his five years of service then only they are eligible for withdrawing the amount partially which is tax-free. Buying or constructing a house.

Consider the EPF interest rate and home loans rates. In this case the amount of withdrawal can be 12 times the. Pay towards the principle of your housing loan thus shorten the loan tenure and save on interest charge.

At least 5 years of contribution to the PF account is a must to withdraw PF money for house purchase. If the EPF rate 85 pa. - Housing loanpurchase of site flat or for construction addition alteration in existing house repayment of housing loan.

For the last financial year 2020-21 is more than the home loan rate as of October 2021 most banks are giving home loans at 66-70 pa you should not make an EPF withdrawal. After a month you can extract the rest 25. The contributory employees of the provident fund PF scheme to use 90.

April 2017 Date of Notification EPF Member can apply for withdrawal upto 90 PF accumulations in PF Account EMI facility to members Withdrawal allowed only once Required - PF Membership of 3 years. - Unemployment of not less than 1 month. The contributory employees to dip into their retirement savings to own a home of their own.

Meanwhile EPF members need to file e-nominations for a number of benefits. Those with NPL status can apply for withdrawal the payment will be paid straight into the housing loan account. With around 25 years of your loan tenure left you have already paid the majority.

If within this 1 month you get fresh employment this 25 gets transferred to your new EPF account. In accordance with Section 68-BB of the EPF Scheme EPF withdrawal is also permissible in case of repayment of any outstanding housing loan. Residential property ROI for appreciation in line with inflation is 5 to 7 yearly rental is 3 to 5 yearly.

However before retiring too you can take money out of your EPF account for a variety of reasons. EPF is 6 for 2011 4. Buy unit trust fund that will outperform EPF 5 currently by applying ringgit cost averaging strategy.

The withdrawal amount will the taken from Account 2 and will. Anyone who is buying or constructing a new house or a flat can use their EPF savings. Min is 8 till 12.

Before withdrawing money from your Employees Provident Fund EPF account to pay off your home loan there are certain aspects you need to consider. PF Withdrawal for Home Loans. When you reach the age of 55 you can start withdrawing money from your EPF account.

What percentage of your salary goes as EMI.

Epf Withdrawal For House Flat Or Construction Of Property Basunivesh

How Epf Can Reduce Your Home Loan Principal Or Monthly Installment Part 1 Black Belt Millionaire

Epf Withdrawal For Flat Purchase Or Home Construction Planmoneytax

Epf Partial Withdrawals Advances Options Guidelines 2020 21

6 Reasons For Which You Can Withdraw Money From Your Epf Account

Epf Withdrawal For Housing Loans Reduction To Withdraw Or Not

4 Simple Steps To Use Your Epf Money To Buy House In Malaysia

How To Own A New Home Through Withdrawal From Kwsp Account 2 Kinta Properties

Kwsp Housing Loan Monthly Installment

Epf Partial Withdrawals Advances Options Guidelines 2020 21

Epf Partial Withdrawals Advances Options Guidelines 2020 21

Ease Your Home Loan With Epf Bloomz Property

Epf Withdrawal For Buying House And Paying Emi New Epfo Rule

Epf Partial Withdrawal Or Advance Process Form How Much

Pf Partial Withdrawal Rules House Purchase Renovation Home Loan

6 Reasons For Which You Can Withdraw Money From Your Epf Account

Ease Your Home Loan With Epf Bloomz Property

Pf Partial Withdrawal Rules House Purchase Renovation Home Loan

6 Reasons For Which You Can Withdraw Money From Your Epf Account